Rene Munguia restores a '62 Ford Thunderbird for a friend to make extra money. Photo/Lara Solt

Rene Munguia restores a '62 Ford Thunderbird for a friend to make extra money. Photo/Lara Solt

Surgery Plunges This Family Into Long-Lasting Credit Card Debt

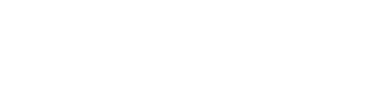

Struggling under a pile of debt isn’t something unique to those with low-paying jobs. The typical Texan carries nearly $4,700 of credit card debt, according to CreditCards.com. That balance tends to increase as income goes up. Despite bringing home $90,000 a year, one North Texas family is struggling to reduce a cache of credit cards.

Brenda and Rene Munguia both have full-time jobs with benefits. She works in the total loss department at GM Financial. He works for MidTech International as an auto painter.

Rene paints cars for friends and neighbors on the side, too, in his home auto shop in the North Texas suburb of Ovilla, 20 miles southwest of Dallas. Brenda calls the shop his “man cave/moneymaker.”

Rene’s auto restorations provide extra income Brenda and Rene need, despite having jobs they love that pay well.

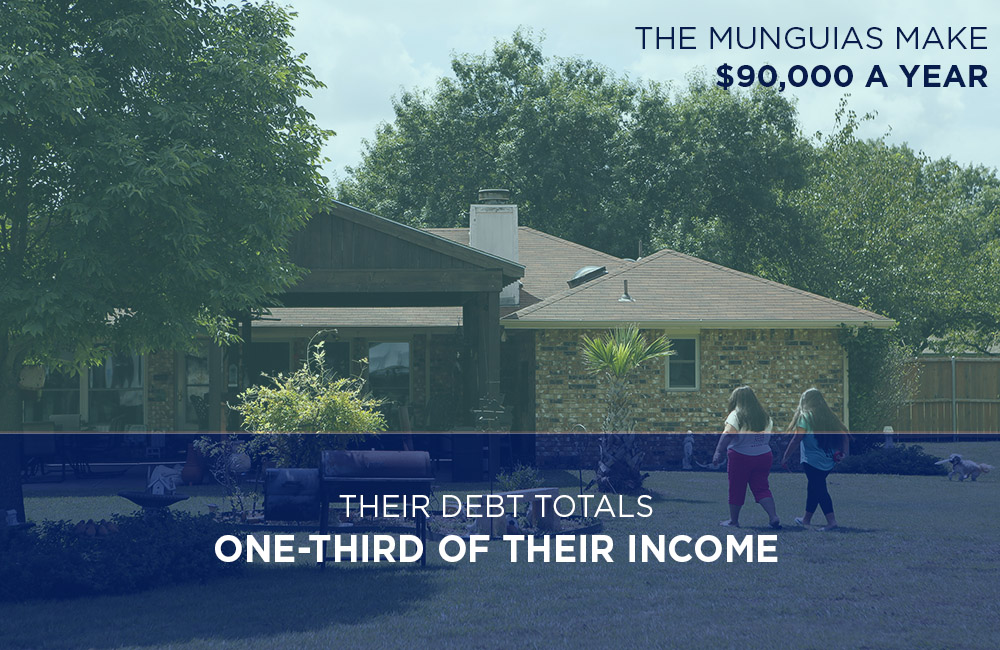

They’re in debt to the tune of about $30,000.

“It’s like $25,000 in credit cards, and a little over $6,000 in medical,” Brenda said.

Rene Munguia works to restore a ’62 Ford Thunderbird for a friend at his home in Ovilla. Photo/Lara Solt

Debt Creates A ‘Domino Effect’

The Munguias’ debt didn’t come on after a job loss or a major purchase. It happened when Brenda was off work for about eight weeks recovering from hand surgery.

She had to pay her health insurance deductible and some doctors’ bills up front. She only made 60 percent of her salary while on short-term disability.

That was enough to throw the family’s whole budget off balance. Brenda said getting into debt created a domino effect.

“You try and borrow from Peter to pay Paul, and you know, just get deeper into debt,” she said. “And by the time … you’re starting to buy groceries with credit cards, get gas with credit cards, and it’s just a never-ending story.”

And with $25,000 weighing down the credit cards, Rene said the minimum payment each month is about as much as his family can afford.

He doesn’t feel good about that.

“I feel like it’s never going to get paid off, No. 1. Because if you make the little minimum payment, you’re never going to finish, period,” he said. “And then what happens is we end up rolling it into another card with a lower interest, and it goes and it goes and it goes and you never finish.”

“It doesn’t matter how much you make or how little you make. People use credit cards because it’s easy.”

LIVING EXPENSES DON’T LET UP

The Munguias have their expenses, too.

They have a teenage daughter, Nalaya. She needs school clothes and participates in extracurricular activities.

They have three dogs and also own a home. If the roof leaks or the air conditioner breaks, they can’t just ignore it.

“You have to put it on the credit card; you have to,” Rene said. “How are you going to come up with $2,000, you know?”

That’s the tricky thing about credit card debt — you can’t stop living while you pay it all off. Creditors don’t push “pause” on your debt while you save up to cover the balance.

At their home in Ovilla, Brenda Munguia and her daughter, Nalaya, wrap ribbon around their fruit trees to keep squirrels away. Photo/Lara Solt

Angela Lair is a certified credit counselor with Transformance, a nonprofit in Dallas.

“It doesn’t matter how much you make or how little you make,” Lair said. “People use credit cards because it’s easy.”

In other words: If your paycheck won’t quite cover the cost of new shoes for your child, or a higher-than-expected electric bill, a credit card’s got you covered.

Then comes time to pay.

“You think, ‘Well, I was going to pay this off, but this bill just came in, and I really need to pay this,’” Lair said. “So before you know it, you’re falling into that cycle of making your minimum payments each month.”

“Put it this way: I’ve been down hard, but I’m not going to lose what I’ve got. I’m going to fight for it.”

Small Changes Make Small Difference

The Munguias have enough money to live on, but not enough to make a real dent in what they owe. Angela Lair said the minimum payment cycle is more costly than most people realize.

“On a $4,000 balance, making the minimum payment, on an interest rate of 18 percent … it will take you about 61 years to pay that off,” Lair said.

Sixty-one years.

Here’s how the math breaks down. The minimum payment starts out at about $80 a month and slowly adjusts down as the card is paid off.

The interest is unforgiving. When all is said and done, you’ll have paid $22,084 — more than $18,000 of that pure interest.

Rene Munguia earns supplemental income by painting cars from his home garage. Photo/Lara Solt

Lair said groups like Transformance can help people work with creditors to lower interest rates and go over spending habits with a fine tooth comb.

At the end of the day, her best advice is the simplest: “Stop using your credit cards,” she says.

Brenda and Rene Munguia are trying to do that. They’ve also started buying off-brands instead of name brands. They bundled cable, internet and phone to take a bite out of those bills.

They even refinanced Brenda’s car, extending the loan from four to six years. That lowered the monthly payment by $200.

Still, nothing seems to free up enough money to make a difference.

“I always say next month, I’m going to pay a little bit more,” Brenda said. “And that little bit more never comes.”

Both Brenda and Rene say they’ll continue to to cut corners on spending wherever they can. Rene said he’ll take side jobs painting every car in the neighborhood if that’s what it takes to stay afloat.

“Put it this way: I’ve been down hard, but I’m not going to lose what I’ve got. I’m going to fight for it,” he said.

It’s a fight this family is determined to win.