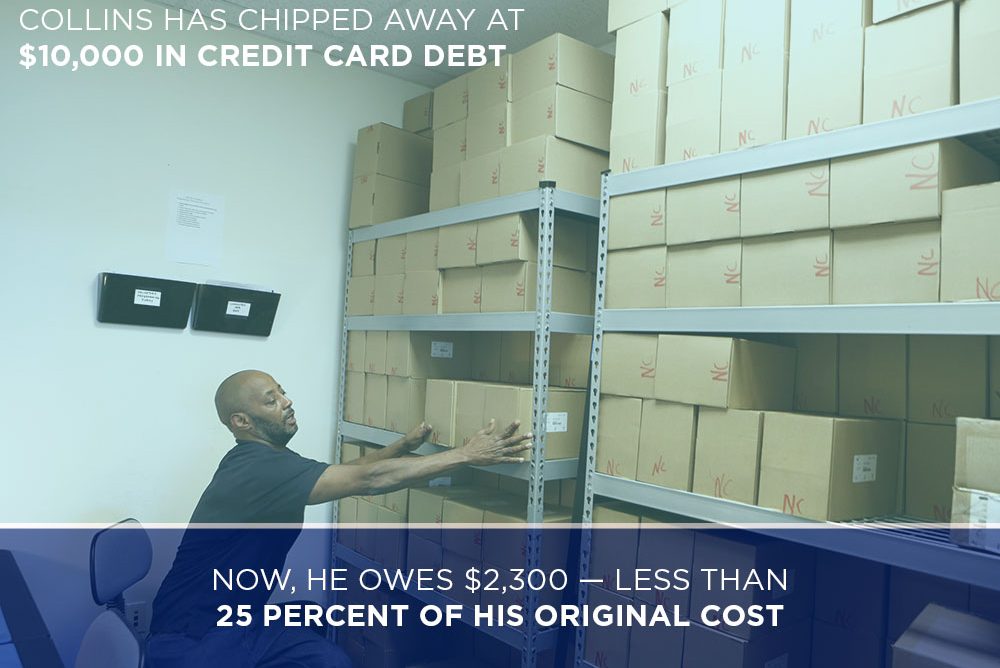

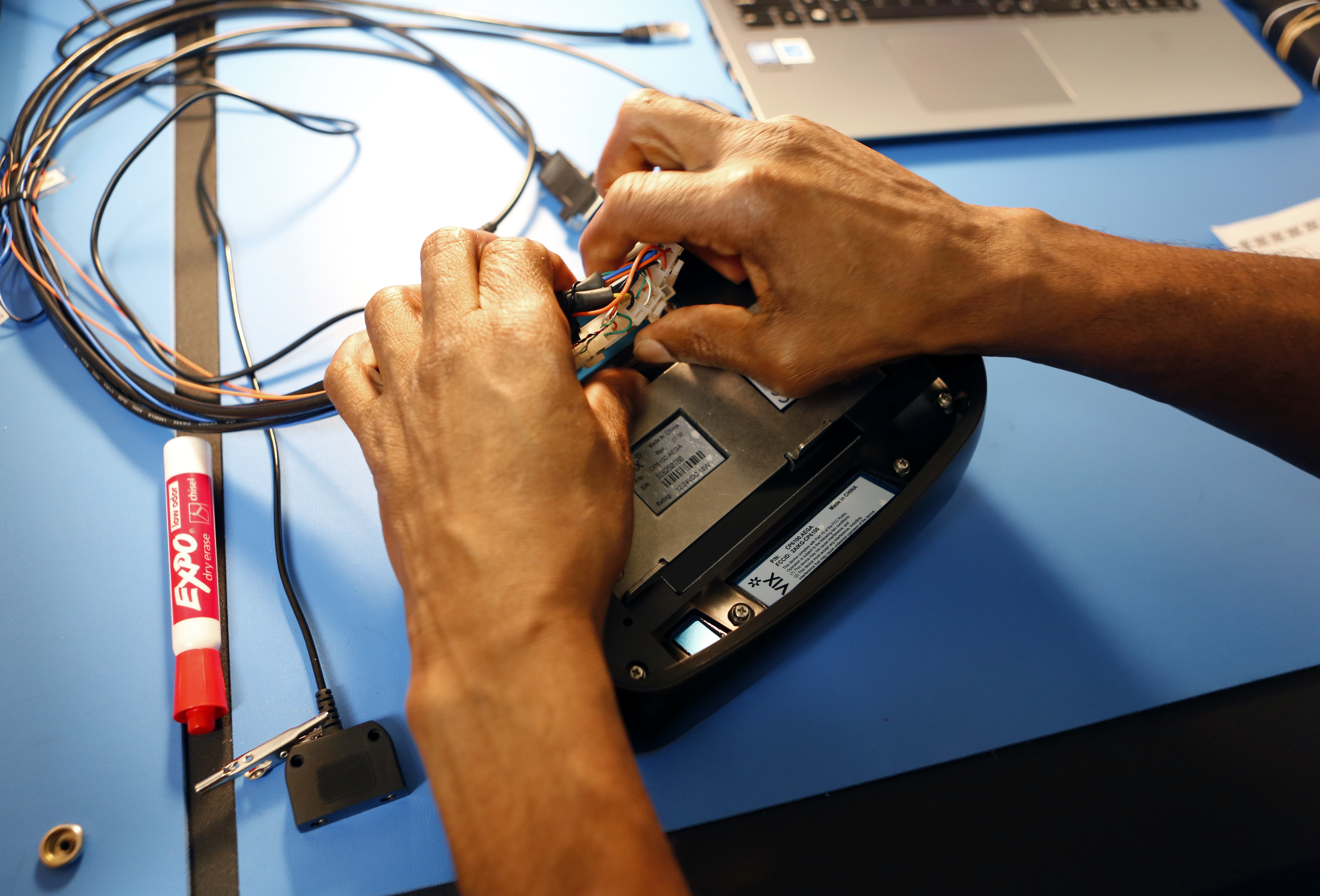

Programmer Angelo Collins works on transit validators

for DART at AAA Data Communications Inc. in Dallas. Photo/Lara Solt

Programmer Angelo Collins works on transit validators

for DART at AAA Data Communications Inc. in Dallas. Photo/Lara Solt

Chipping Away At A Mountain Of Unpaid Child Support

Most people are working to pay down something: a mortgage, a credit card balance, a car note. There’s another kind of debt, too — an account that’s fallen behind. Back taxes, child support, an old cellphone bill. They’re called delinquencies. They can wreck a credit score and stick around for years.

AAA Data Communications in southern Dallas is a quiet place to work. Angelo Collins likes it that way.

He’s alone in a small office filled with boxes. Inside each one are validators for Dallas Area Rapid Transit busses. They’re basically wireless “easy-pay consoles” for riders to use. Collins programs each one, downloading software and repacking the box once the device is ready to go.

It’s a full-time job with benefits that pays $18 an hour — money Collins is grateful to have. He’s working to become debt free after getting divorced last year.

“I had to kind of regroup myself and mentally prepare myself to put things back in order,” he said.

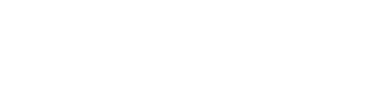

Programmer Angelo Collins fell back on child support after taking a year to focus on his education. Photo/Lara Solt

Collins has two teenagers. He and his wife were separated for several years before the divorce was finalized. Child support bills piled up while he worked and went to school.

In 2014, he took on a full course load studying electronics and telecommunications.

“I just concentrated on school for that one year, so that kind of dropped me, put me back on child support,” he said.

Collins fell $6,000 behind. He’s back to making payments now, but hates the pile of debt with his name on it.

He illustrates his point by standing a pen on top of his desk, and dragging it slowly across the surface.

“Let’s say this is a mountain, and it has your name attached to it,” he explains. “In nowadays that we live in, that stays on your name. Wherever you move, that moves with you, that same mountain. You pull that mountain behind you.”

Programmer Angelo Collins works on transit validators for DART. Photo/Lara Solt

Constantly Catching Up

His financial coach at Catholic Charities Fort Worth is helping him chip away at that mountain, so it’s a little easier to pull.

“They give me advice in all phases of my life. Stressful, financial, employment, all sorts of direction and support,” he said. “They kind of provide that outlet to me.”

Alisha Wilkinson is a case manager with Catholic Charities and says many clients are working on accounts that are past due.

“Debt such as back taxes that you owe, you could have unpaid balances on different services that you had, whether that’s your electric, your cable bill, your gas bill,” she said. “You could owe a balance to an apartment or a house you used to rent.”

Many folks who go to Catholic Charities are just like Collins — people trying to catch up on child support, which doesn’t stop accruing when someone fails to pay.

The Texas Attorney General’s Office handles 1.5 million child support cases. In 2015, $4.55 billion in current support was due — that doesn’t include delinquent payments. About $1.5 billion, or 35 percent, wasn’t paid.

Wilkinson says one of her clients is paying child support — and his child has children.

“He paid it down from about $90,000 and he is now seeing the light at the end of the tunnel,” Wilkinson said. “He has about $3,000 left to pay, but that’s something that he’s been paying his whole adult life.”

Delinquent Debt Can Be Persistent

Old child support is one of those debts that’s inescapable. If someone’s employed, wages can be garnished. Depending on how many kids are involved, up to 50 percent of a salary can be diverted to pay child support. Tax refunds and Social Security income count, too.

“You might attack the biggest of the most persistent debts, and then after getting a handle on those, you can turn your attention toward other debts to manage,” Wilkinson says.

Wilkinson says some of those debts like an unpaid cable bill, old parking tickets or an overdrawn bank account will fall off a credit report in seven years. Others won’t — especially if a collection agency decides to sell a debt to a new company.

Programmer Angelo Collins is working to pay down debt accrued from missed child support payments. Photo/Lara Solt

“Ten plus years could pass and you think that it might be off of your credit report by that time, but because new creditors are continuing to pursue this debt, it will remain on your credit report and remain active,” Wilkinson says.

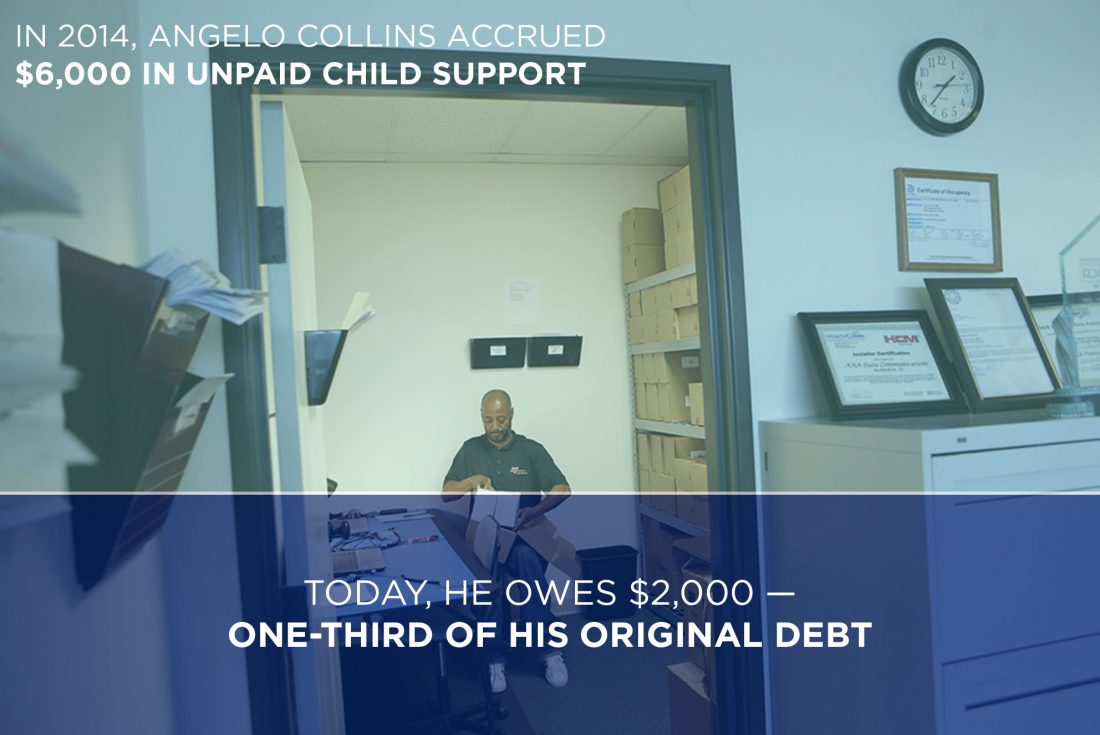

Collins just settled an outstanding bill with Verizon. He’s brought that child support balance from $6,000 to $2,000. He’s also chipped away at $10,000 of credit card debt, with only $2,300 left to pay off.

And his credit cards?

“I cut all them up,” he said. “I got rid of them.”

It’s an important step toward becoming debt-free and free of the burden that comes with owing money you don’t have.

“Once that mountain is gone, then I have to maintain,” Collins says. “I don’t want to get back there.”

He’s looking forward to a day when his mountain of debt is just a memory.

Drowning In Debt: Series Recap

For the past month, KERA’s series One Crisis Away: Drowning In Debt has focused on everything from credit cards to child support — and the ways many North Texans are struggling to stay on top of what they owe.

Courtney Collins reported these stories. She sat down with Executive Producer Jeff Whittington to recap the series.